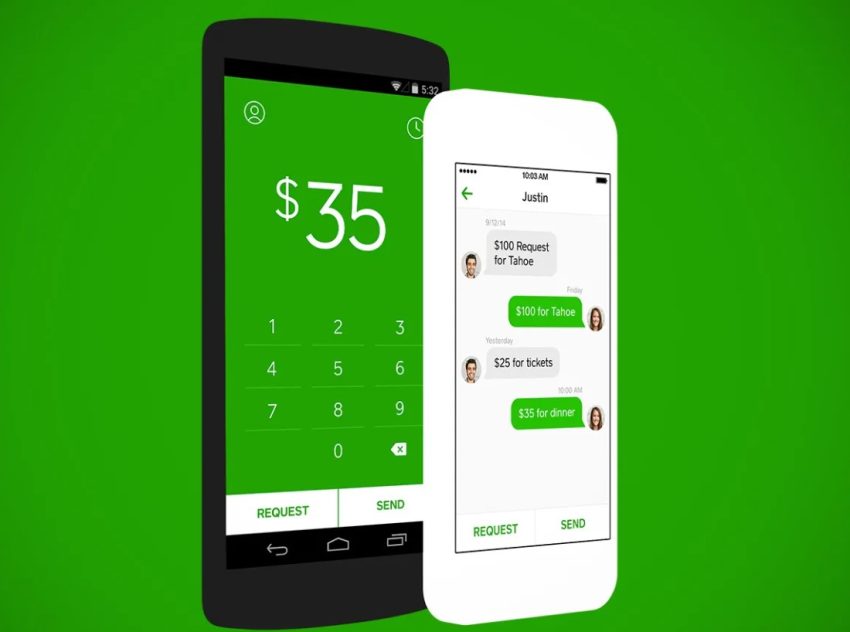

In today’s digital age, managing your finances and making transactions have become more convenient than ever, thanks to financial technology (FinTech) applications. Cash App, developed by Square, Inc., is a leading platform that allows users to send and receive money, invest, and even purchase Bitcoin. In this article, we will delve into the world of Cash App money, exploring its various features and how it can revolutionize the way you handle your finances.

Cash App Money: A Comprehensive Overview

Cash App Money represents the digital currency and the financial power at your fingertips. It enables you to perform a variety of financial activities efficiently and securely. Here are some key features of Cash App Money:

1. Sending and Receiving Money

Cash App Money is all about facilitating transactions. You can send money to friends, family, or anyone in your contact list with a Cash App account. The process is as simple as entering the recipient’s email address or phone number and the amount you want to send. Likewise, you can receive money from others through the app.

2. Cash App Card

One of the most significant features of Cash App Money is the Cash Card. This is a customizable debit card linked to your Cash App account, which allows you to make purchases and withdraw money from ATMs. The Cash Card is an excellent tool for accessing your Cash App balance in a physical form.

3. Bitcoin Investment

Cash App Money goes beyond traditional currency by enabling you to invest in Bitcoin, the world’s most well-known cryptocurrency. The app provides a user-friendly interface for buying and selling Bitcoin. This feature has contributed to Bitcoin’s growing popularity and acceptance in mainstream finance.

4. Direct Deposit

You can also use Cash App Money for direct deposit. Cash App provides users with a routing and account number, making it easy to have your paychecks and other direct deposits sent directly to your Cash App account. This feature eliminates the need for a traditional bank account.

5. Cash App Investing

Cash App Money isn’t just for sending and receiving payments. The platform also offers Cash App Investing, which allows users to invest in stocks and exchange-traded funds (ETFs). You can start investing with as little as $1 and easily manage your investment portfolio through the app.

6. Cash Boosts

Cash App offers a unique rewards program known as Cash Boosts. These are like cashback deals that provide discounts on specific purchases made with your Cash Card at partner merchants. It’s a fantastic way to save money on everyday expenses.

How to Get Started with Cash App Money

To start using Cash App Money, you’ll need to follow a few simple steps:

1. Download the Cash App

First, download the Cash App from the App Store (iOS) or Google Play Store (Android). The app is free to download and install.

2. Sign Up

Open the app and choose to sign up. You’ll be asked to provide some basic information like your name and email address.

3. Link Your Bank Account or Debit Card

For full access to Cash App Money’s features, link your bank account or debit card. This step is crucial for adding funds to your Cash App balance, sending money, and making purchases.

4. Verify Your Identity

Cash App may require additional information to verify your identity, a standard practice for financial services. This verification process helps protect your account and ensure security.

5. Explore the Features

Once your account is set up, you can start sending and receiving money, investing, using the Cash Card, and taking advantage of Cash Boosts to save money on your purchases.

The Significance of Cash App Money

Cash App Money has a significant impact on the way people manage their finances and transact in the digital age. Here are some key aspects of its significance:

1. Accessibility and Inclusion

Cash App Money makes financial services more accessible to individuals who may not have access to traditional banking institutions. The ability to send and receive money, invest, and access financial services via a smartphone app promotes financial inclusion.

2. Investment Opportunities

The inclusion of investment options like Bitcoin and stocks within Cash App Money empowers users to become more financially literate and make informed investment decisions. It provides an entry point for people who may not have considered investing before.

3. Ease of Use

The user-friendly interface and features of Cash App Money make it convenient and straightforward to manage one’s financial life. The ability to send money, receive payments, invest, and save on everyday expenses creates a comprehensive financial ecosystem.

4. Digital Currency Adoption

By offering users the ability to buy, sell, and hold Bitcoin, Cash App Money contributes to the growing adoption of digital currencies in the financial industry. This helps demystify cryptocurrencies and makes them more accessible to the general public.

Conclusion

Cash App Money has revolutionized the way we handle our finances and transactions. With its wide array of features, from sending money to investing in stocks and Bitcoin, Cash App Money provides a versatile and user-friendly platform for managing your financial life.

As the world continues to embrace digital finance, Cash App Money plays a significant role in bringing financial services to a broader audience, promoting financial literacy, and contributing to the adoption of digital currencies. With the power of Cash App Money in your hands, managing your finances has never been more convenient and accessible.